Introduction

Accounting in the present-day world is not just recording transactions related to money, funds, and financial affairs. However, Accounting plays a vital role concerning decision making, offering relevant information, assisting in plans. Having theoretical and practical knowledge in accounting is a must for the decision-makers in every organization. To achieve Success in Accounting based interviews, I have prepared a list of Top 50 Accounting Interview Questions and Answers for the benefit of employees or candidates who want to pursue a career in Accountancy.

It is crucial for all firms to generate and maintain Income Statements, Cash flow Statements, and Balance Sheet. So that reports are prepared for the management to make decisions.

Accounting Interview Questions

Here is the list of Top 50 Accounting Interview Questions and Answers

Q1. Tell us the difference between Accounts, Accounting and Accountancy?

Answer. Accounts refer to the preparing and presenting the financial information in the pattern of debit and credit, in other words, Accounts is a synopsis of all transactions.

Accounting is an art and a process of Summarizing, Analyzing, Interpreting, Recording, Classifying, Measuring, Communicating information. All this information available in figures is interpreted for further decision making.

Accountancy is a wider concept explaining the theory, principles (Book keeping, Accounting, Auditing) and practice of accounting.

Q2. Can you tell us the different kinds of accounting?

Answer. The different kinds of accounting are –

Financial Accounting – This stream of accounting records, elaborates and communicates the organization’s financial proceedings over a period of time.

Administrative Accounting – Administrative accounting highlights the administrative features of the organization. Additionally, it gives access to the defined goals and develops the enforced plans. This results in making futuristic decisions and continuing with the action plans with the available resources.

Tax Accounting – It assists to register and generating reports connected to tax returns to the public treasury and payment of taxes.

Cost Accounting – This accounting concentrates on businesses of industrial nature. Furthermore, It assists in making a comprehensive evaluation of the unit costs of production, its process and the sales the organization creates.

Management Accounting –This accounting has a wider view compared to cost accounting as it reports all the economic and finance-related particulars of the organization to be capable of making temporary and permanent decisions.

Q3. Can you tell us the kinds of business transactions present in accounting?

Answer. We can find two kinds of business transactions in accounting, they are Revenue and Capital

Q4. Can you tell us the major difference between inactive and dormant accounts?

Answer. Yes, these two accounts have a slightly different meaning as per accounting. here , inactive accounts are those kind of accounts which have been terminated and will not function in future at all. On the other hand, Dormant account are those kind of accounts which are not operational today but are surely put to use in the future.

Q5. Can you mention some accounting software?

Answer. FreshBooks, NetSuite ERP, Tipalti, FreeAgent, Zoho Books, Sage,Business Cloud Accounting, Sage 50cloud,QuickBooks, Microsoft Dynamic GP, and Tally

Q6. On which accounting platforms have you practiced on? And your preferred software.

Answer. Kindly give a brief introduction to the accounting software you practised on and mention your preferred accounting software. Similarly, it also mentions the benefits to the company in implementing it.

Confidently, speak out on the mastery on the subject you achieved and the benefits the companies attain in using these accounting platforms.

Q7. What is the balance sheet?

Answer. A balance sheet elaborately presents the exact financial status of the organization’s assets, liabilities and owner’s equity for a particular period of time.

Q8. What is TDS?

Answer. The full form of TDS is Tax Deduction at Source. Wherever income is generated tax is deducted from the employee’s salary account.

Q9. Can you define departmental accounting?

Answer. Departmental accounting is a kind of accounting process used by the firms to administer the accounts of all other departments in separate books or separate software platforms. Here, each department must prepare a profit and loss account along with Trial balance. As a result, the profitability of the entire firm is disclosed.

Q10. Do you think accounting standards are unavoidable?

Answer. In any organization Accounting standards are unavoidable as they depict a quality role and present faultless financial status. Hence, ensuring validity, reliability, and relevance in all its statements.

Q11. Define executive accounting?

Answer. Executive accounting is a type of accounting that is specifically designed for a business that offers services to users.

Executive Accounting is especially formulated for service oriented businesses that need an advanced accounting system, besides being an easy to use accounting system. Furthermore, it has modern features like invoicing, multi-currency attributes, Combination of various bank attributes. Again this executive is based on a single-user system which can be updated to many users.

Q12. What do you mean by Public accounting?

Answer. Public Accounting is a service which offers accounting assistance to various companies. Here accountants offer expert knowledge, verification and tax related favors to their members. Most importantly, it reviews the firm’s financial status and assures accountability.

Q13. Can you clarify on maintaining accuracy in accounting?

Answer. With the emerging accounting softwares, we can maintain accuracy in various ways in an easy manner. If not, the company will face huge losses in all its aspects. The following transactions like recognizing revenue sources, observing invoices and receipts, formulating financial statements, tracing deductible expenses and preparing tax returns.

Q14.Explain the fundamental difference between accounting and auditing?

Answer. Accounting is concerned with reporting the financial day-to-day business activities of the firm. Whereas Auditing is concerned with accurate verification of all the events, transactions, and monetary dealings which have taken place in the firm.

Q15. Can you explain the basic accounting equation?

Answer. The Equation is – “Assets = Liabilities + Owners Equity”

Q16. Differentiate between Accounts Receivable (AR) and Accounts Payable(AP)

Answer.

|

Accounts Receivable (AR) |

Accounts Payable (AP) |

|

It is short-term related Current Asset |

It is short-term related Current liability |

|

The funds are collected by the company from outsider suppliers |

The funds are paid by the company to outside suppliers |

|

Amount received in the event of credit sales. |

Amount paid in the event of credit purchases. |

|

Creates Cash inflows to the company |

Creates cash outflows to the company. |

Q17. What is working capital?

Answer. Working Capital is that capital utilized in routine business activities, and is the result of current liabilities deducted from current assets.

Q18. What is Scrap Value in accounting?

Answer. Scrap value is also known as residual value, salvage value, or break-up value. In any firm, when the asset’s value is no longer in use then the asset’s independent parts get a monetary value called the Scrap value.

Q19. Explain a balance sheet?

Answer. It is a statement that mentions the entire Liabilities and Assets of the firm at a particular period of time.

Q20. Define depreciation.

Answer. Depreciation represents the actual value of the tangible asset being used. It is an accounting approach to set aside a certain amount towards the asset for its productive life.

Depreciation actually is the declining value of the asset which is in use. This is required for computing the firm’s net income in each accounting period.

Q21. Can you tell us the different kinds of depreciation?

Answer. This is a follow-up to the previous accounting interview question. Mention the following, common depreciation methods.

1.Straight Line Depreciation – the amount allocated remains the same for every year.

Here, “Depreciation = [Cost – Salvage Value/ Useful life]”

2.Declining balance depreciation – in this method the value of the asset is reduced by a fixed percentage rate which is higher in the beginning and charged less in the later years.

“Depreciation = Net book value of the asset * Depreciation Rate”

3.Double Declining Balance – Double declining balance depreciation approach allots a double of the normal depreciation rate.

“Depreciation on periodic basis = [Beginning book value * Depreciation rate] *2”

- Sum of the years’ digits – This method is implemented to highlight the identification of depreciation. In the very first years only the asset gets recognised for its productive life. Also known as the SYD method.

“Depreciation Expense = (Remaining life / Sum of the years digits) x (Cost – Salvage value)”

- Units of Production – Here, the asset is depreciated taking the total number of units that are utilized or the number of hours the asset is used is taken as base, over its useful life.

“Depreciation = [ (Number of units produced/Life in number of units)* (Cost – Salvage Value)”

Q22. Can you give the differences between Provision and Reserve.

Answer. Provisions indicate allocating funds for overcoming a future liability. Also called as Expense

Reserves indicate allocating funds from profits for future use. Also called as Profits.

Q23. Define Partitioning.

Answer. Partitioning is done to get maximum clarity on the financial transactions and to evade confusion in accounting. Ultimately, it is division/subdivision/grouping/regrouping of financial dealings under several heads in a given accounting period.

Q24. Tell us the three basic elements of cost.

Answer. Cost consists of three basic elements namely

1) Material

2) Labour

3) Expenses

Q25. What do you mean by “deposit in transit”?

Answer. A deposit in transit means a cheque or cash which has been acknowledged by the firm and yet to be entered in the books of the bank where the cash amount is deposited.

Q26.What is Bad debt expense?

Answer. Bad debts are the amounts which owe to the firm but are irrecoverable amounts. These funds can never be collected by the firm from its debtors. Bad debt expense and appears in the assets side as accounts receivable of a company and is considered to be irrecoverable account expenditure or doubtful account expenditure

Q27. Can you tell us when goodwill increases?

Answer. Goodwill is an intangible asset owned by the firm and is directly connected with the functioning of the firm. If a firm is acquired for more than its original value, then the firm is rewarded for the intangible items like copyrights, brand value, skilled people, loyalty, and intellectual rights.

Q28. What do you know about Personal, real and nominal accounts? Give examples.

Answer. A personal account is an account which is directly or indirectly connected to persons, companies, firms or corporations. For example. Client’s account, Capital Account, employees account.

A real account is an account which is directly connected to assets and liabilities. For example, land account, building account.

A nominal account is an account which is directly connected to income and expenses. For example, salary account, wages account.

Q29.What do you mean by double-entry bookkeeping?

Answer. Double-entry bookkeeping refers to an accounting principle where every transaction is entered in two places called accounts.

Q30. Briefly define the procurement process.

Answer. Procurement follows a particular procedure to acquire a purchase order. The steps to be followed are to save costs, save time, and maintaining supplier relationships

- Purchase request

- Verification and approval Delivery terms

- Supplier payment terms

- Contract Commitment

- Issue of purchase order to supplier

- Acceptance from Supplier

Q31. Mention the types of ledgers

Answer. There are three types of ledger

- General ledger

- Debtors ledger

- Creditors ledger

Q32. Elaborate the primary difference between the trial balance and balance sheet?

Answer.

| TRIAL BALANCE | BALANCE SHEET |

|

It considers personal, real and nominal accounts. |

It considers only personal and real accounts. |

|

The balance of accounts appear in the same order as shown in the ledger. |

They appear in the order of liquidity or in the order of permanency. |

|

This is produced to test the arithmetic accuracy and identify errors. |

This is produced to present the financial status of the firm. |

|

Not significant and can be dropped |

Most significant and must be produced |

Q33. Explain computerized accounting?

Answer. Computerized accounting is identified as an operation that modifies raw data into meaningful information. The aim of this kind of accounting is to present information for decision making. Likewise, financial data is gathered, processed,and concluded into final reports.

Q34. What is accounting ethics?

Answer. Accounting ethics refers to following specific rules and guidelines regulated by governing authorities each and every individual as well as entities must obey to avert any kind of misapplication of funds, position and their details.

Q35. What do you mean by vouching in accounting?

Answer. Vouching in accounting refers to perfect checking of all the finance entries through documentary evidence like invoices, bills, receipts and statements.

Q36. What Is Payroll in accounting?

Answer. Payroll accounting refers to the computation, recording, reporting and evaluation of employees’ or workers compensation. It comprises the basic salary plus other payments that arise in the time of their service.

Q37. What do you mean by Ratio Analysis?

Answer.Ratios exhibit meaningful and useful relationships between financial information. In the similar way, Ratio analysis is just a medium to recognise the financial drawbacks and the strengths of the firm. It is helpful to the firm in many ways like predicting the future costs of the business, aids in maximizing capital structure, internal and external comparisons, preparing budget estimates, evaluating liquidity, profitability, efficiency, and solvency, judging the bankruptcy situations, and the best utilization of assets.

Q38. Can you tell us how you minimize the fear of making mistakes in your work?

Answer. One must possess the habit of checking , reviewing and feel free to raise doubts before submitting the work. Here, communication plays a very crucial role. In case of discrepancy, one should shoulder the responsibility.

Q39. Explain about non-performing assets?

Answer. A non performing asset (NPA) cites the category for money lent or advances that are remitted or due. The main amount or interest payment remains overdue for more than 90 days.

Q40. Explain about BEP in accounting.

Answer. Break Even Point (BEP) in accounting and business, means the production level of entire revenues equals the entire expenses. A point in which the firm has no profit or no loss.

Q41. Explain about the cost sheet.

Answer. A cost sheet assists you in providing the exact details of all the costs incurred in producing the product or service that too at every level of the production process. Overall information pertaining to a specific period, on total cost and cost per unit of the product is mentioned. Similarly, it assists in deciding on the sale price and budgets to be allocated for production of product or service.

Q42. Explain about Chargeback?

Answer. A chargeback refers to the amount reversed by the bank or any other entity of the cardholder after a dispute is charged on their account.

Q43. Can you give the calculation for debt-to-equity ratio?

Answer. The debt-to-equity ratio is calculated as the percentage of a firm’s debt in connection with its shareholder’s equity. A high level firm’s risk is involved with a high debt equity ratio, adding to the competitive advantage.

The formula is –

“Debt-to-equity = Total debt/Shareholder’s Equity”

Q44. Can you brief us on IFRS and why it is important for accounting.

Answer. IFRS full form is International Financial Reporting Standards. This is an accounting framework to regulate the common global standards and it is licensed by the International Accounting Standards Board. As a result it boosts efficiency, crystal clear accounts, and presents the highest accountancy. Similarly IFRS requires a Financial status statement, an income statement, Equity changes statement, and Cash flow statement.

Q45. Can you explain when you capitalize rather than expense a purchase?

Answer. Any particular thing’s cost is capitalized if it is foreseen to be used by the firm permanently. Simultaneously, their economic value also appreciates.

Q46. Give us the calculation for Earnings Per Share?

Answer. Earnings Per Share or EPS is the amount earned by the equity holder per share which is from the earnings of the entity. It ca be arrived using the formula

“EPS = (Net Income – Preferred Dividends)/Average outstanding common shares”

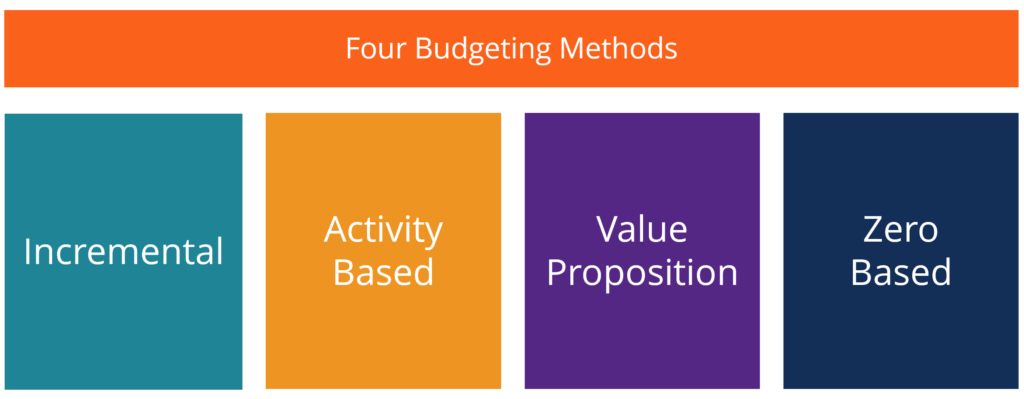

Q47. Give us an explanation why a company requires different budgeting methods? Tell us the most significant ones.

Answer. Planning the firm’s financial resources for future use through effective budgeting not only brings profits but saves the firm from bankruptcy. The significant budgeting methods are

Incremental budgeting – this is common and easy to apply. As it considers previous year’s data and adds or subtracts a percentage to attain the present year’s budget.

Activity-based budgeting is a top-down approach that decides the required inputs to carry out the targets set by the firm. Here, the activities are considered first to and later costs incurred are found out.

Proposition budgeting evaluates a few things before implementing it. They are:

- Why should a particular amount be taken in the budget?

- Will that particular amount create value for the firm, its clients, employees, and stakeholders.

- Is the amount justified to the value of the item.

This kind of budgeting makes the firm think about the value it generates, and stays away from unnecessary expenses.

Zero-based budgeting is a popularly used method as it assumes that all divisions’ budgets are zero and must be restarted from the beginning. This is a type of bottom-up approach that can be most rewarding. On the other hand, it is best suited for non-essential costs and needs more time to bring in success. So firms implement this method rarely.

Q48. Tell the latest accounting trends prevailing in 2022?

Answer. In accounting every transaction, analysis and entries are dependent mainly on the trending softwares and networks available in the web world. They are

- Automated accounting processes

- Rise of accounting software solutions

- Outsourcing accounting functions

- Cloud-based accounting

- Focus on data analytics

- Blockchain

- Utilizing social media

- Advisory services

- Artificial Intelligence

- Big data in accounting

- Remote work setting

Q49. Can you tell us some common errors in accounting?

Answer. A few common accounting errors are –

- “Error of omission”

- “Error of commission”

- “Error of original entry”

- “Error of accounting principle”

- “Compensating error”

- “Error of entry reversal”

- “Error of duplication”

Q50. What made you attend this interview?

Answer. I strongly feel all my skills are well-suited to this particular position because of the updated software being used and in trend with the market demands. Furthermore, this firm is recognised through its clients and it is popular for the services it offers.Indeed, I personally feel great in associating with this company for gaining reputation from satisfied clients.

Henry Harvin Education: Business Accounting and Taxation Course

Henry Harvin’s Finance Academy’s recognized Accounting and Taxation course is customized to the latest technology adopted in the industry. Being the best in training students and corporates, it was and is an award-winning institution.

Candidates get 172 hours online or offline learning with an instructor. It has adopted the Goal-Centric Action-Oriented (GCAO) learning method to achieve faster results.

Course Details

- Learn about – Supply or Levy, Place of Supply, Value of Supply, Export & Import, E-Way Bills n Module

- Knowledge on – Registrations, Input Tax Credit & ITC04, Transitional Provisions, Job Work n Module

- Practical sessions on – Account & Records, Invoice, Tax Payments, Time of Supply, Returns, Refunds n Module

- Validation skills in – Litigation Management, Audit & Assessments, Offenses & Penalties, Demand & Recovery

Henry Harvin’s Business Accounting and taxation course is available in other cities

Agra, Bangalore, Chennai, Delhi, Kolkata, Hyderabad, Surat.

Other Henry Harvin Courses:

- Post Graduate program of Accounting and Taxation course

- GST course

- Income Tax Course

- Financial Modeling Course

Conclusion

A recognised course in Accounting and Taxation is a must to start a career in accounting. Your success in interviews depends on how confidently you speak, the best body language, your grooming skills and of course the knowledge you possess. An interview needs brief answers, simple and to the point. A bit of preparation in mind and body is required.Read the latest articles in newspapers, social media and magazines to get a hook on the latest happenings.

Visit their website thoroughly and note down key points on mission, vision, policies, theirs achievements, and targets.

Give positive, short and crisp answers for personal background questions.

So All the Very Best and Go Ahead!

FAQs for Accounting Interview Questions and Answers

Basic common sense is a must for any accountant. Here are few skills listed :

Alertness must in managing all departments

Clear and crisp communication skills, both written and oral

Problem solving skills

Time management skills

Accounting software knowledge

Arithmetic and Reasoning skills

Creative and critical thinking

Always ready to learn and adopt.

Any accountant plays a key role in the affairs of the company. For instance, managing employees payroll, auditing the books of accounts, decision making in the finance department, updating the back-end support system. There is a great demand for skilled and experienced accountants in the market today. So All the best and positively Go Ahead..

Firstly, have confidence that you can obtain any skill through learning and practice. Secondly, get to read financial statements, learn to create spreadsheets, and study accounting books. Thirdly, join a recognized Accounting course. Fourthly, focus on how to apply financial accounting principles and equations in the real-world. Finally, network with industry accounts experts.

Many silly mistakes are committed in accounting which lead to huge losses. A few are listed here

Not following the communication protocols.

Employee’s personal expenses being mixed with firm’s accounts

Not maintaining a backup support system.

Not allocating resources on time or misallocating.

Not properly maintaining receipts.

Not updating the book of accounts.

Manual accounting not matching system accounting. Only one to be maintained.

![Harvin Harvin Education Reviews: 2023 [Updated]](https://bestcoursenews.com/wp-content/uploads/2023/01/download-28-100x70.jpeg)

The Accounting & Taxation interview questions and answers shared on this website were incredibly informative. The content showcased the depth of knowledge required in these fields, offering aspiring professionals a solid foundation for success. A must-read for anyone pursuing a career in finance.

This website provides a comprehensive list of accounting interview questions and answers, making it a valuable resource for anyone looking to ace their accounting job interview.